georgia ad valorem tax trade in

Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. Ad valorem tax fee provisions of OCGA.

This tax is based on the value of the vehicle.

. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their. Multiply the vehicle price before trade-in or incentives by the sales tax fee.

Georgia Motor Vehicle Forms are available at. Thereafter exempt from annual ad valorem tax. DOWNLOAD CURRENT TAVT ASSESSMENT MANUAL TITLE AD VALOREM TAX CALCULATOR.

TAVT rates are set by the Georgia Department of Revenue. For example imagine you are purchasing a vehicle for 45000 but the fair market value is 40000. Cash discount and trade-in when the sale is from a dealer.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. PdfFiller allows users to edit sign fill and share all type of documents online. Vehicle Taxes Dekalb Tax Commissioner.

You would pay 66 on the 40000 amount not the 45000 you paid. The trade-in value of another motor vehicle will be deducted from the value to get the taxable value. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

This one-time fee is based on the value of the car not the sales price. A trailer weighing less than 3500 pounds used exclusively to haul agricultural products from one place on the farm to another or. For the answer to this question we consulted the Georgia Department of Revenue.

Retail selling price is defined to include the sales price plus any fees. 48-5C-1 created by HB 386 passed during the 2012. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

If I itemize deductions on Federal Schedule A can I deduct my auto registration and ad valorem tax. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. You can calculate the Title Ad Valorem Tax by finding the fair market value of the vehicle and multiplying it by 66.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. How to Calculate Georgia Tax on a Car.

Ad Register and Subscribe now to work with legal documents online. The minimum is 725. Please use this convenient link to reach the Georgia Tax Commissioners Tag Office Location.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. If the sale included a trade-in the FMV is first reduced by that amount before multiplying by the applicable rate to determine the TAVT due. TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles.

Vehicles subject to TAVT are exempt from sales tax. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. Title Ad Valorem Tax TAVT Currently TAVT is 66 of the retail value assessed value established by the Georgia Department of Revenue or clean retail value shown by the NADA.

Per the Georgia Department of Revenue Only the ad valorem tax portion of the annual auto registration can. This calculator can estimate the tax due when you buy a vehicle. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie.

For example imagine you are purchasing a vehicle.

Tavt Tax Calculator Fmv Dealer Guide Georgia Independent Auto Dealer Association

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Vehicle Taxes Dekalb Tax Commissioner

![]()

Georgia New Car Sales Tax Calculator

Infographic Which Countries Are Open For Business Business Regulations Business Infographic

State By State Guide To Taxes On Retirees Kiplinger

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

Tavt Tax Calculator Fmv Dealer Guide Georgia Independent Auto Dealer Association

Monopoly Luxe Edition For Sale In Lawrenceville Ga Offerup Monopoly Gifties Lawrenceville

Sales Tax On Cars And Vehicles In Georgia

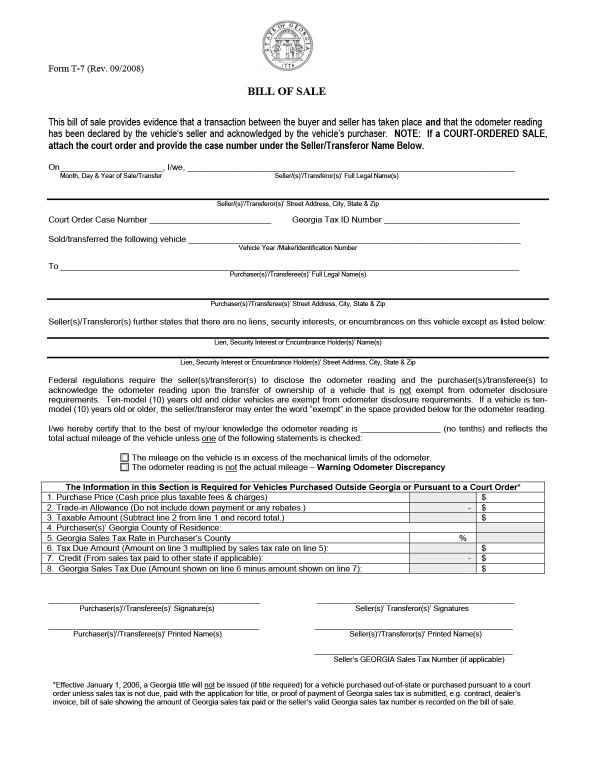

Georgia Bill Of Sale Templates For Autos Boats Firearm And More

Tavt Tax Calculator Fmv Dealer Guide Georgia Independent Auto Dealer Association

Infographic Which Countries Are Open For Business Business Regulations Business Infographic

Georgia Used Car Sales Tax Fees

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tavt Tax Calculator Fmv Dealer Guide Georgia Independent Auto Dealer Association

Bank Guarantee For Trade Finance Or For Import Amp Amp Export